Warehouse Will Call Tax Table - FIL 42

In some states, the will call tax rates are dependent on the business address of the customer as well as on the business address of the warehouse servicing the customer. This means that different customers who will call (pick up goods) at the same warehouse may be charged different tax rates. It also means that the same customer can be charged different tax rates if that customer will calls from different warehouses of the same business and those warehouses are in different areas in terms of taxation.

This option creates a table that automates the taxation of will calls in such states. The Warehouse Will Call Tax Table automatically adjusts the tax codes on an order, based upon the business address of the customer as well as the business address of the will call warehouse.

The Warehouse Will Call Tax Table is available via option 42 on the File Maintenance (FIL) menu.

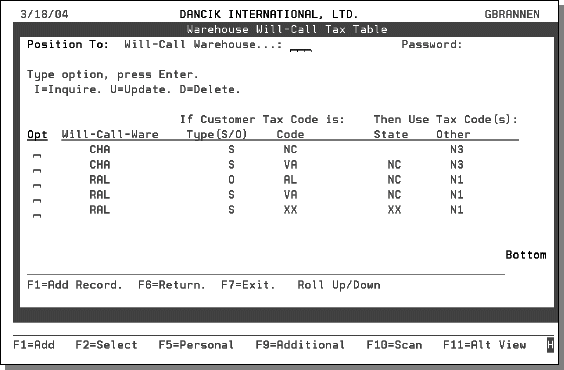

Listed below are some examples of how this table works:

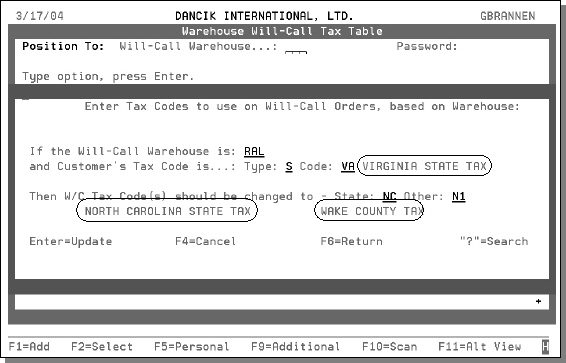

- The first entry in the table above reads as follows: If the Will Call Warehouse is CHA (Charlotte), and the customer's state tax code is NC, then keep the state tax code as NC and make the Other tax (in this case it is a Charlotte city tax) N3.

- The fourth entry reads as follows: If the Will Call Warehouse is RAL (Raleigh), and the customer's state tax code is VA, change the state tax code to NC and the Other tax code to N1 for Wake county.

The fields on this screen are described in the following table.

|

Field |

Description |

|

Will-Call-Ware |

This is the warehouse where the material is going to be picked up. This warehouse relates to the header warehouse of an order. This table is used only if the Will Call tax Table is activated in the System Wide Settings. If the Will Call Tax Table is not activated, then the system checks for will-call tax rates in the Warehouse File |

|

If Customer Tax Code is: Type (S/O) Code |

This information reflects the current tax type (S= State Tax and O=Other Tax) and tax code of the customer. The O tax code can apply to any type of tax that isn't a state tax (i.e., county or city tax). This information is found in the Billto file. When a will call (customer pickup) order is entered, the Order Entry program checks for this tax type and Tax code and if it is entered into the Will Call Tax Table it is automatically converted to the values shown in the Then Use columns. |

|

Then Use Tax Code(s): State Other |

These are the codes that are used to assess taxes on will call customers. When an order is processed for a will call customer, the order entry program accesses the Will Call Tax Table and changes any applicable tax codes to the ones in this column. |

To add a new entry to the table, press F1. After entering the information, press Enter. The screen refreshes to show information related to your entries.

The will call tax table uses the same password as the Tax File.

You may use this feature to change a will call tax table rate to zero.

- Create a tax code with a rate of zero

- assign that tax code whenever you want to change the rate to zero

Associated Files

- Options for Sales Tax

- Options for Taxes On Will Call Orders

- Billto File Profile Screen - FIL 1

- Warehouse File - FIL 8

- Tax File - FIL 16

- Tax Calculator - CUS 25

- Tax Identification Number File - ACT 12

- County File - FIL 33

- Tax by Zip Codes Table - FIL 43

- Option 4 - Tax, G/L & Delivery/Route Options

- Tax Exemptions by State/Province File Maint. SYS 605

- Tax Exemptions by State/Province File Listing - SYS 606